Refinancing

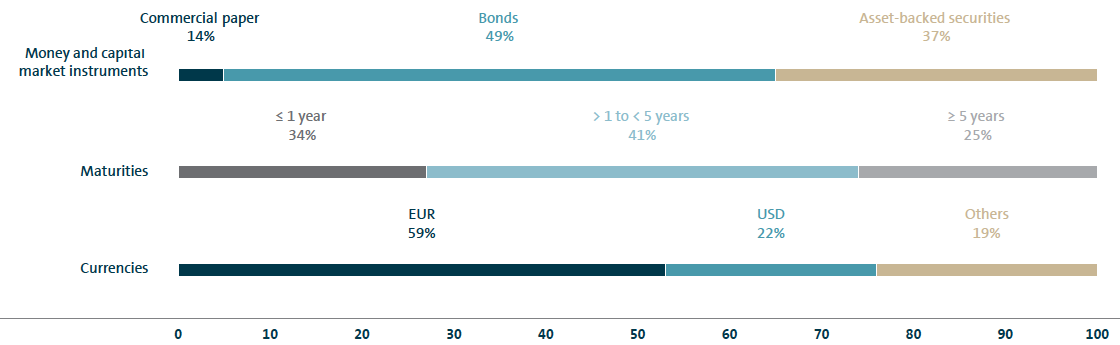

REFINANCING STRUCTURE OF THE VOLKSWAGEN GROUP

as of December 31, 2016

As a result of the diesel issue, the Volkswagen Group’s ability to access individual refinancing instruments in the money and capital market in 2016 was restricted. Our activities were therefore marked by diversification in certain instruments and markets. One focus was the issue of commercial paper, especially in Europe and in the currency euro.

Asset-backed securities (ABS) transactions were another important element. The Financial Services Division placed ABS transactions with a value of €4.0 billion in the eurozone. An ABS credit facility of USD 9.0 billion was entered into with a banking syndicate in the USA. The Volkswagen Group also issued other ABS transactions in Australia, China, the United Kingdom, Japan and Sweden with a value of €3.6 billion.

A bond was issued for the first time in China’s local capital market. Other transactions were executed in currencies such as the Swedish krona, Russian ruble and Indian rupee.

In addition, the Automotive Division issued a public promissory note with a value of €1.1 billion.

The share of fixed-rate instruments was roughly twice as high as the share of variable-rate instruments.

In all refinancing arrangements, risks related to interest rates and currency are generally excluded by entering into derivatives contracts at the same time.

The table below shows how our money and capital market programs were utilized as of 31 December, 2016 and illustrates the financial flexibility of the Volkswagen Group:

| (XLS:) |

|

|

|

||

PROGRAM |

Authorized volume € billion |

Amount utilized on Dec. 31, 2016 € billion |

||

|---|---|---|---|---|

|

|

|

||

Commercial paper |

26.8 |

13.4 |

||

Bonds |

129.4 |

47.7 |

||

of which hybrid issues |

– |

7.5 |

||

Asset-backed securities |

73.2 |

36.5 |

The €20.0 billion syndicated credit line for Volkswagen AG that was agreed with a banking syndicate in December 2015 was extended until June 2017. After exercising an extension option in 2015, the syndicated credit line of €5.0 billion agreed in July 2011 was extended to April 2020. Both credit lines were unused as of the end of 2016.

Syndicated credit lines worth a total of €2.4 billion at other Group companies have also not been drawn down. In addition, Group companies had arranged bilateral, confirmed credit lines with national and international banks in various other countries for a total of €8.5 billion, of which €2.6 billion was drawn down.